97% of Evaluated Drugs are Overpriced, According to ICER

2018 was not a good year for biopharma manufacturers, based on the Institute for Clinical and Economic Review’s (ICER) evaluation of interventions across various disease areas. Seemingly every month, ICER generated negative press for the biopharma industry. Headlines read:

Where do these ICER headlines come from?

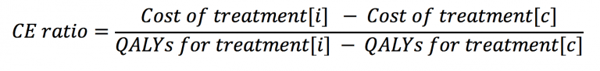

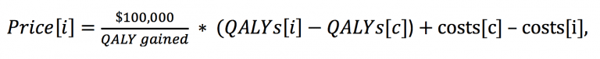

These headlines are a direct result of ICER’s calculation of a value-based price (VBP), which is defined as the price at which the intervention meets pre-defined cost-effectiveness (CE) thresholds. To estimate a VBP, ICER uses fixed CE thresholds of $100,000 and $150,000 per QALY gained as inputs, among others, and solves for the intervention’s price. Using the incremental CE ratio calculation,

and a CE threshold of $100,000 per QALY gained, ICER solves for the intervention’s price as illustrated below:

where [i] is the intervention, [c] is the comparator, costs[i] do not include the total per patient costs associated with the price[i], and each component of the calculation is measured on a per-patient basis.

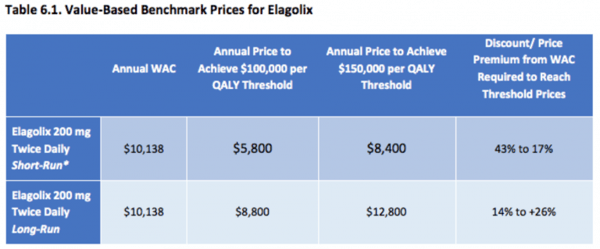

ICER’s evaluation of elagolix for the treatment of endometriosis serves as an example of their VBP assessment. In their final evidence report, ICER presented the following table, in which they communicate the WAC, the prices to achieve $100,000 and $150,000 per QALY gained, and the discount from the WAC:

Source: ICER. Elagolix for Treating Endometriosis. Final Evidence Report, August 2018.

In 2018, how often did ICER recommend a price reduction?

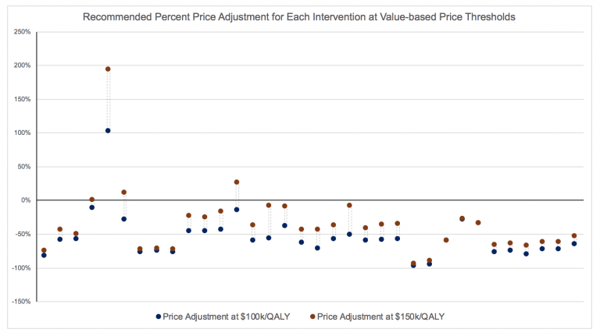

All of the negative headlines got us thinking – how often in 2018 did ICER recommend a price reduction? We evaluated ICER’s proposal for all interventions studied during the year, which amounted to a total of 34 interventions across 10 disease areas. Our findings are astonishing:

At the $100,000 per QALY gained threshold, ICER recommended that 97% of interventions be discounted, with a median price reduction of 60%.

At the $150,000 per QALY gained threshold, ICER recommended that 88% of interventions be discounted, with a median price reduction of 42%.

The following scatter diagram illustrates the percent price adjustment for all 34 interventions.

What can manufacturers do to challenge ICER findings?

Be prepared, well ahead of an ICER evaluation. In the months (or even years) before ICER’s starting gun goes off, it’s important to engage in a range of strategic initiatives that could influence ICER’s model design, and thus the VBP.

One initiative should be to design and implement your own robust and flexible early-stage CE model. These models set expectations for internal cross-functional teams by providing early indications of the CE of an intervention along with clinical efficacy targets and VBPs needed to meet pre-defined CE thresholds.

Does spending the time and resources on strategic initiatives make a difference?

Yes – ICER listens, provided you have the proper evidence to support your claim. Recently, in ICER’s assessment of CGRP inhibitors for the preventive treatment of episodic and chronic migraine, manufacturers advised against the use of off-label active therapies as the model comparator due to the lack of evidence to support their inclusion. ICER heeded manufacturer advice and moved the comparison of off-label therapies to the scenario analysis; the base case analysis, instead, compared CGRPs to no preventive therapy. Doing so, as you can imagine, had a favorable impact on CE ratios and VBPs for the manufacturers’ interventions.

So, why should you plan for ICER?

Clearly, the risk of ICER recommending deep price discounts is high. With ICER’s rising influence in the payer and PBM communities (see last summer’s announcement from CVS Caremark), lost revenue from deep price reductions is a tangible outcome from an ICER evaluation. The benefits, therefore, of partnering with an organization to prepare for future evaluations is justified. For more information regarding how we can help you in preparation of and throughout the ICER review processes, please contact us.